A Form W-2 is more than simply a piece of paper; it is just one of the most crucial documents you need at tax obligation time. Right here’s what a W-2 is, exactly how to comprehend what’s on it, and also just how you can get a copy if yours is shed.

What is a W-2 Form?

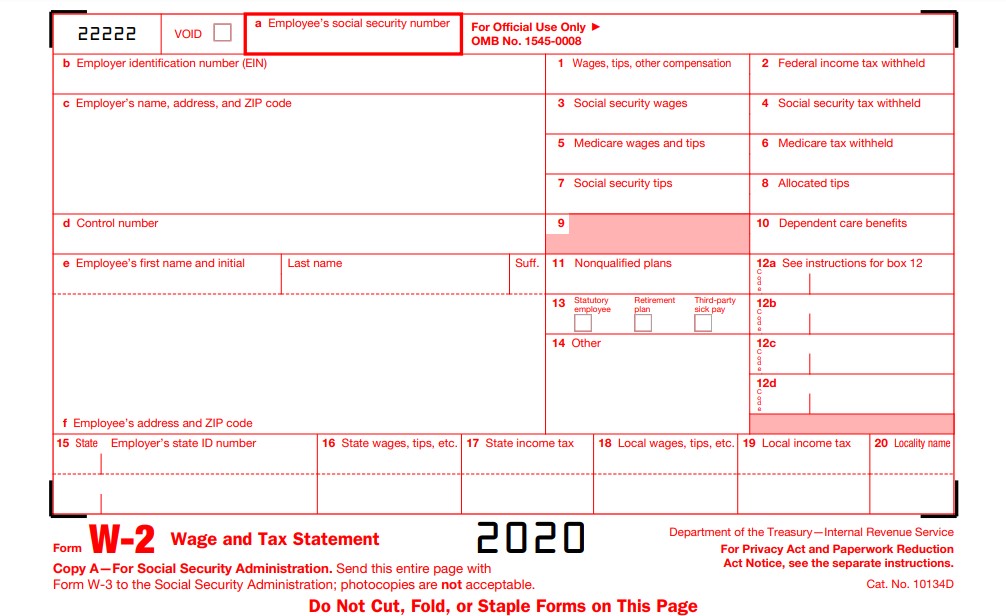

Internal Revenue Service Form W-2, the “Wage as well as Tax Obligation Declaration,” reports a worker’s revenue from the previous year, just how much tax obligation the employer kept, and also various other information. Companies send employees a Form W-2 in January (and also a copy to the IRS). Staff members make use of Form W-2 to prepare their tax returns.

The Fundamentals of the W-2 form

- The IRS requires companies to report wage and salary information. Companies do that through Form W-2.

- Do not perplex a W-2 with a W-4– that’s the form you make use of to inform your employer just how much tax obligation to withhold from your paycheck every pay duration (learn exactly how withholding taxes function).

- Companies should send out employees a W-2 by the end of January every year Your employer may send you instructions for just how to obtain your own online.

- Every company that paid you at the very least $600 during the year has to send you a W-2. Tip income may get on it.

- For many individuals, the information on the W-2 figures out whether they’re getting a refund or writing a check at tax obligation time.

You Need Your W-2 to Do Your Tax Obligations

- Your Form W-2 informs you just how much you gained from your company in the past year as well as how much withholding tax you’ve already paid on those revenues.

- You’ll require it in order to fill up in a lot of the info when you do your taxes.

When Do W-2s Obtain Sent Out?

The IRS needs companies to equip W-2s to the federal government and also staff members by Jan. 31 or face charges. The Internal Revenue Service generally defines provide as “get it in the mail,” which suggests you must have yours in hand by the very first week of February.

- Employers can also send staff members their W-2s electronically, but it’s not called for. That implies you might have the ability to get yours online.

- Even if you stop your job months earlier, your ex-employer can still wait till Jan. 31 to send you a W-2– unless you ask for it previously, in which situation the company has 30 days to offer it.

- Interesting note: If you pass away, you’ll still obtain a W-2 that year.

If Your W-2 is Incorrect, What To Do

- If your company neglects a decimal point, obtains your name or a dollar amount incorrect, or checks the wrong box– it takes place– explain the mistake and request for a dealt with W-2

- Mentioning the mistake as well as awaiting a brand-new W-2 will certainly cost you time, but here’s something that can make you feel better: The Internal Revenue Service might find your employer if the mistake entails a buck quantity or “a substantial item” in your address.

What to Do If You Shed Your Form W-2

First, ask your company for a duplicate as well as make sure it’s obtained the appropriate address if your W-2 doesn’t show up by Valentine’s Day.

- If that does not take care of things, call the IRS (right here’s a list of useful IRS contact number). When you functioned and an estimate of what you were paid, you’ll need to give info concerning.

- Remember that your income tax return is still due in April, so you could require to estimate your withholdings as well as incomes to get it done in a timely manner. (Go right here to get more information regarding getting an extension.) And also, the Internal Revenue Service could delay refining your return.

- If your W-2 finally appears after you already submitted your tax return, you could need to go back as well as amend your income tax return.

W2 Form 2020 Form

Loading...

Loading...