What is an IRS 1099 form?

A 1099 form is a record that an entity or individual aside from your employer-provided or paid you money. The payer submits the 1099 form and also sends duplicates to you as well as the Internal Revenue Service. There is numerous type of 1099 forms.

1099 is a “details filing form”, made use of to report non-salary earnings to the Internal Revenue Service for federal tax objectives. There are 20 variations of 1099s, yet one of the most prominent is the 1099-NEC. You’ll require to complete a 1099-NEC if you paid an independent service provider much more than $600 in a monetary year.

A person can likewise earn money from tax obligation dividends, reward payouts, interest earnings, IRA distributions, state tax refunds, assorted government repayments, the sale of personal effects, and even charge card financial obligation mercy. These kinds of revenue are reported on other types of Form 1099, which you can check out all about below.

If you’re a local business owner, you’ll frequently be taking care of Form 1099-NEC, so we’ll focus on that person.

Who Must File Form 1099?

Individual taxpayers are generally exempt from actually finishing any 1099 forms, other than in a few circumstances. For example, if you have a small company and also you employed an independent specialist, you may be called to complete a form 1099. Generally, banks and also employers (when suitable) produce all their called for 1099 forms. Taxpayers typically get duplicates of all 1099 forms that apply to them either electronically or by mail by very early February. Payers of 1099 forms– financial institutions, employers, etc.– are called to file their 1099 forms by Jan. 31.

If your service employed the service provider and paid them more than $600 in a year, you’re responsible for issuing them a 1099-NEC. Simply put, the payer fills in 1099.

Does that Get a 1099 Form?

The function of a 1099 form is to videotape income. All kinds of individuals can obtain a 1099 form for various factors.

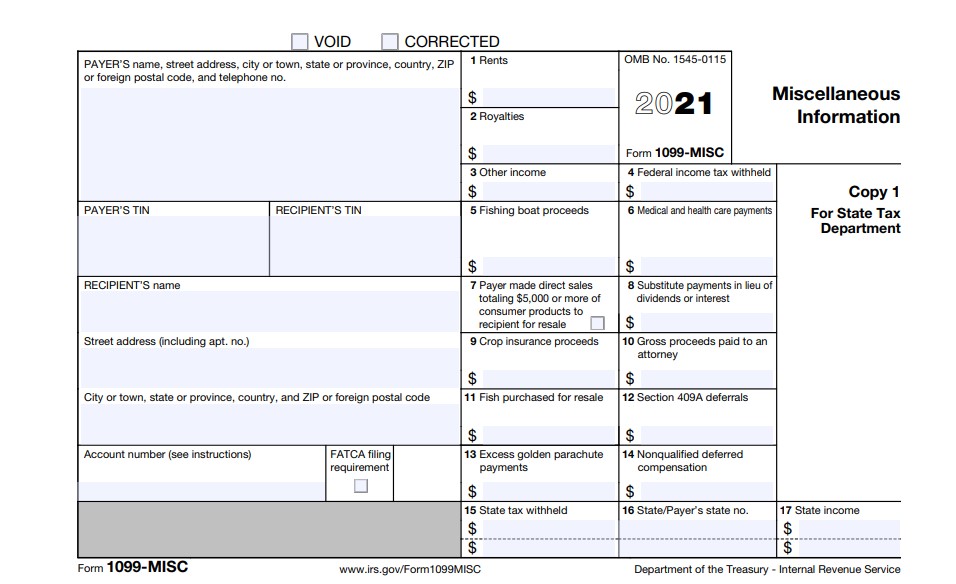

For example, consultants and independent service providers frequently get a 1099-MISC from their customers. The form reflects the cash the customer has actually paid the consultant or independent professional. 1099 is not the same as a W-2, which is for employees.

A Form 1099 will certainly have your Social Security number or taxpayer-identification number on it, which means the Internal Revenue Service will recognize you have actually obtained cash– as well as it will certainly recognize if you do not report that revenue on your tax return.

Simply receiving a 1099 tax form doesn’t always suggest you owe tax obligations on that money. You might have reductions that balance out the income, for example, or some or all of it may be sheltered based on qualities of the asset that produced it. All the same, keep in mind: The Internal Revenue Service understands about it.

What is the 1099 Tax Return Used For?

You utilize your IRS Form 1099s to figure out how much earnings you got during the year as well as what sort of revenue it was. You’ll report that income in different places on your income tax return, relying on what type of revenue it was.

1099 MISC Form 2020 Printable

Loading...

Loading...