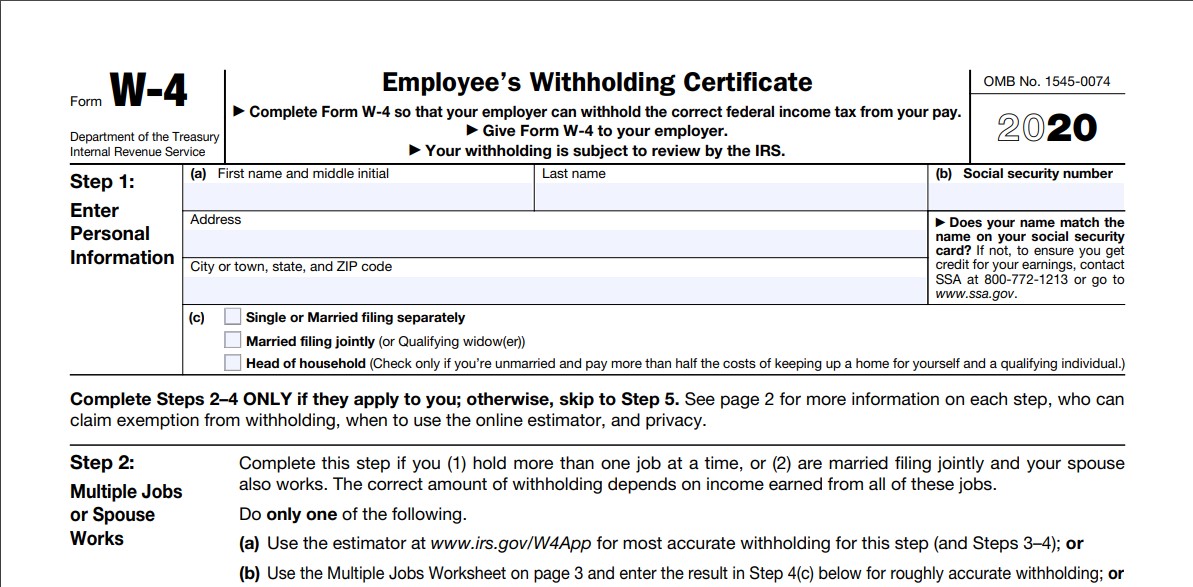

What’s properly to fill in a W-4 Form? That’s the tax return called a W-4 Staff member’s Withholding Certification that your employer hands you when you start a new job. If tax return fills you with fear– you don’t comprehend them, you’re afraid of what will certainly occur if you slip up– simply maintain analysis. This write-up will clarify what a W-4 is and walk you through just how to fill out the type, which was totally revamped in 2020, line by line.

A W-4 form, officially entitled “Worker’s Withholding Certification,” is Internal Revenue Service develop workers use to inform companies how much tax obligation to keep from each income.

The company utilizes the W-4 to calculate particular payroll tax obligations and also pays the tax obligations to the Internal Revenue Service and the state on the worker’s behalf.

Why You Need to Submit a W-4?

Earnings tax obligation is a pay-as-you-earn event– the min you earn money, the Internal Revenue Service desires its cut. That’s why the W-4 exists: It’s a type that instructs your company just how much tax obligation to withhold from each paycheck. Your company remits that total up to the IRS in your place, as well as at the end of the year, your employer will certainly send you a W-2 showing (among other things) just how much it held back for you that year.

What Is Form W-4 Made Use Of For?

You complete a W-4 type to ensure that your employer will certainly keep the appropriate amount of earnings tax obligation from your income. If you have an accountant or another tax preparer, validate your decisions with them prior to you kip down the form.

The means you load out Kind W-4, Staff member’s Withholding Certificate, identifies just how much tax obligation your company will certainly keep from your income. Your withholding counts toward paying the annual earnings tax obligation costs you determine when you file your tax return in April.

You can claim an exemption from withholding any money if you did not owe tax throughout the previous year as well as anticipate to have absolutely no tax obligation in the following year.

What’s the Most Effective Means to Submit Your Type W-4?

Below’s the general technique:

- You can utilize Type W-4 to boost your withholding if you obtained substantial tax costs in April and don’t want an additional. That’ll aid you to owe less (or absolutely nothing) following April.

- You’re giving the government free finance and can be unnecessarily living on much less of your paycheck all year if you obtained a massive reimbursement last year. Think about utilizing Kind W-4 to lower your withholding.

W4 Form 2020 Printable

Loading...

Loading...