What Is Form 1040: United States Person Income Tax Return? Form 1040 is the common Internal Revenue Service (IRS) form that private taxpayers make use of to submit their yearly income tax returns. The form contains areas that need taxpayers to reveal their taxable income for the year to determine whether extra tax obligations are owed or whether the filer will get a tax obligation reimbursement.

If you’re submitting an earnings tax obligation as an independent service provider or consultant in the United States, it’s time to get very closely familiarized with Form 1040.

Comprehending Form 1040: United States Person Income Tax Return

Form 1040 needs to be submitted with the IRS by April 15 in many years. Everybody who earns income over a certain threshold should submit an income tax return with the Internal Revenue Service (organizations have various forms to report their revenues).

The IRS overhauled the 1040 form for the 2018 tax year after the passage of the Tax Cuts and also Jobs Act and it checked out, according to the agency, “ways to boost the 1040 declaring experience.” The new, shorter 1040 was billed as easing communication of future tax-law modifications as well as decreasing the variety of 1040s from which taxpayers must choose.

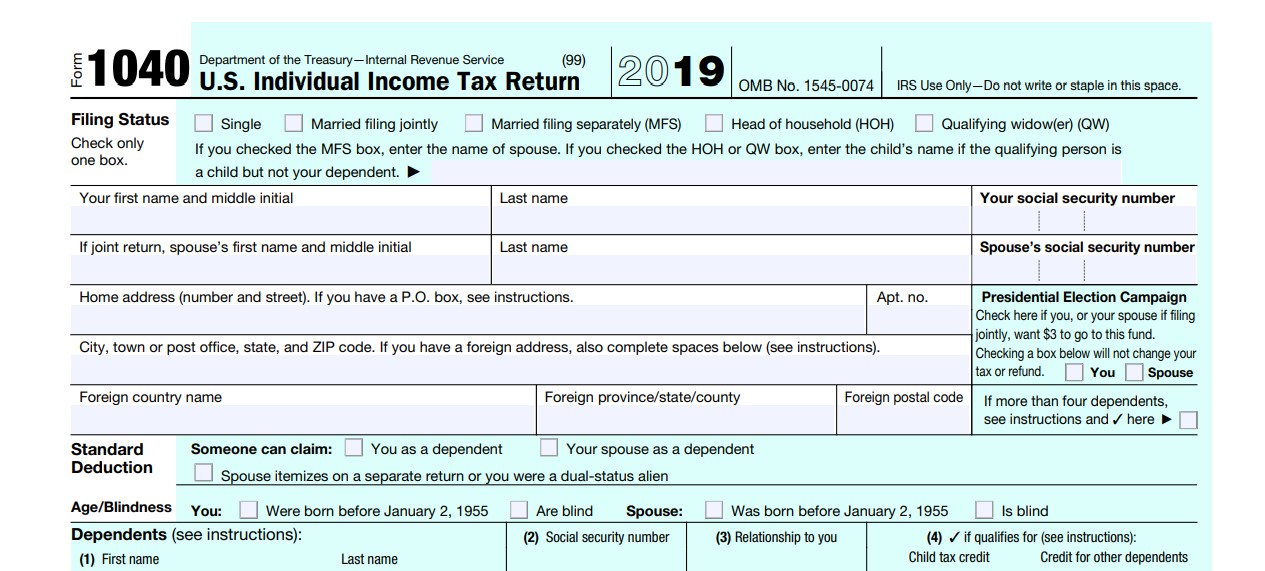

The 1040 form for the tax obligation year 2019, which will certainly be filed in 2020, includes two web pages to complete.

All web pages of Form 1040 are available on the Internal Revenue Service internet site. Form 1040 can be mailed in or e-filed.

Form 1040 motivates tax filers for information on their filing condition, such as name, address, Social Security number (some info on one’s spouse may likewise be needed), and the variety of dependents. The form additionally asks about full-year wellness insurance coverage and also whether the taxpayer wishes to contribute $3 to presidential campaign funds.

What is Form 1040?

Form 1040 is how people file a federal income tax return with the Internal Revenue Service. It’s utilized to report your gross earnings– the cash you made over the past year– and just how much of that income is taxed after tax obligation credit scores and also deductions. It calculates the amount of tax obligation you owe or the reimbursement you get.

This form can take care of multiple incomes and extra complicated tax situations that an independent service provider or freelancer may face.

If you’re a sole proprietor, you’ll include Set up C with your Form 1040 to report revenue or loss from your service.

Exactly How to Get Form 1040

The IRS provides a PDF variation of Form 1040 that you can download and load out manually, however, your best bet is possible using one of the preferred tax obligation software programs. The software application will certainly stroll you with completing the form, any kind of essential timetables that opt for it, as well as assist with the math.

Whichever approach you select, the form is separated right into areas where you can report your income and also reductions to establish the amount of tax obligation you owe or the reimbursement you’ll receive.

Where to Send by Mail Form 1040

The address to which you’ll send your return depends on the state in which you live if you desire to file a paper return. You can find that address in the Internal Revenue Service Directions for Form 1040.

If you’re able, e-filing is the preferred means to submit Internal Revenue Service Form 1040. Or else, a lot of tax obligation prep software programs as well as tax obligation experts are licensed to electronically submit Form 1040.

If You Make a Mistake on Form 1040

If you made a mistake on your 1040 as well as need to make a change, you can do that on Form 1040X. You have three years from the date you file your federal tax return to make a correction.

1040 Form 2020 Printable

Loading...

Loading...