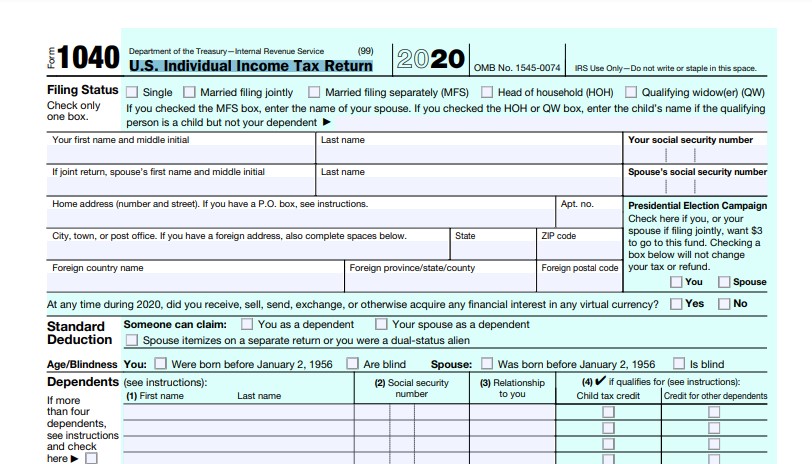

Here is a quick guide to the various 1040 forms you will find when searching for a copy of your U.S. Individual Income Tax Return. The IRS 1040 form, also known as IRS Form 1040, is among the most important documents you will use to file your personal tax return with the IRS. The 1040 form divided into many sections where you report all your income and other deductions to properly calculate the amount of tax you should or can expect to get. It can be very confusing, especially for those who are not very familiar with it. There are a few ways to make the process easier for you.

Check Your State Tax Returns

Most states have a similar income tax filing schedule. If your state tax returns are arranged in the same way, it will make the process of preparing your 1040 easier. The schedule will tell you what tax forms you need to fill out on what date, which will make preparing the tax filing faster.

Print the 1040 Form

The IRS 1040 form can be printed by the taxpayers using certain software available in many computer stores. This will allow you to print it from the office or home printer. Most taxpayers use ink-jet printers for printing their documents because they produce crisp, colorful, professional results.

Lookup a Copy of the IRS 1040-NR Online

The taxpayers can find this IRS form online through the IRS website. This will give you the option of downloading and printing the paper form, which is good if you are short on time. However, the online version does not allow the taxpayers to download the paper form directly.

Print the Paper IRS 1040 Form

After downloading and printing the IRS 1040 form, you should send it back to the IRS. You may need to send it by mail so that it reaches the IRS promptly. You may also need to send the paperback within a specific time period. Some taxpayers may need to do this every year. It is best for you to know this so that you will know when you need to do it.

Print IRS 1040-SR Refund Agreement

The IRS wants to make sure that it is paid on time. The taxpayers should print this IRS receipt. When the filer sends the completed IRS 1040 form to the IRS, the filer should get a receipt from the IRS. In some cases, the filer will receive a confirmation about the amount that needs to be refunded.

1040 Form 2020 Printable

Loading...

Loading...