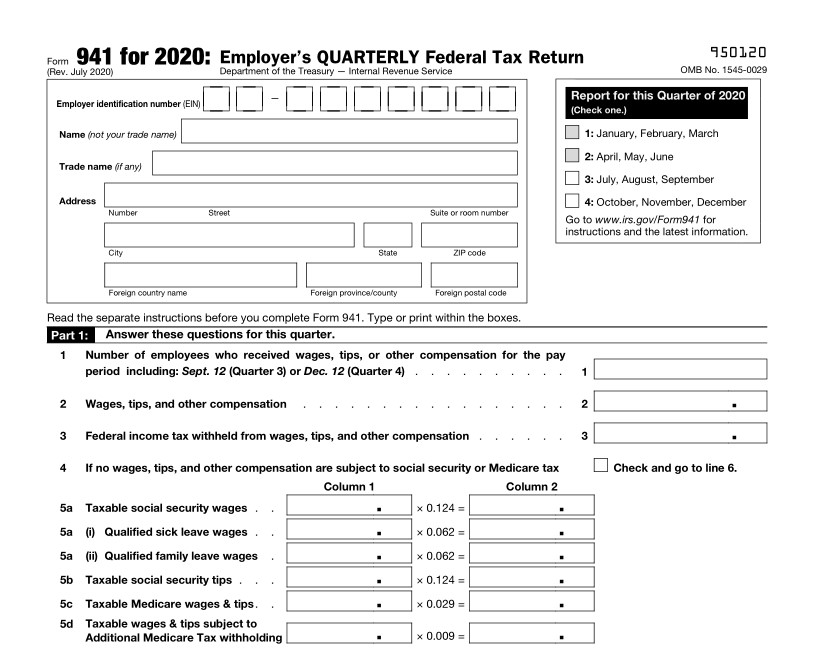

Companies are in charge of submitting Form 941, Every quarter Federal Tax Return to report withholding, Social Security and Medicare (FICA) tax obligations.

Form 941 needs to be submitted every 3 months by the last day of the month complying with the quarter.

Form 941 needs to be submitted even when you have no tax obligations to report, except for seasonal companies as well as those that are submitting their last return.

What is Form 941?

Internal Revenue Service Form 941, the Company’s Every quarter Federal Tax Return, is an Internal Revenue Service form made use of by companies to report government earnings tax obligations, Social Security tax obligation, or Medicare tax obligation withholding from staff member’s incomes.

Where Do You Submit Form 941 for 2020?

urged to subscribe to submit your Form 941 digitally. f you are submitting a paper return, where you mail it relies on if you are making a repayment with the return or otherwise. You will certainly discover the mailing addresses in the Form 941 guidelines. It is based upon what state your business lies.

The Value of Comprehending Form 941

The objective of the 941 return is to see to it that the quantities we reveal for responsibilities connections bent on our down payments, deferment as well as credit reports. This is specifically made complex considered that alleviation stipulations have actually currently impacted pay-roll documents as well as coverage.

Just How to Prevent Form 941 Late Declaring Charges?

You can prevent fines as well as passion if you do every one of the following:

- Down payment or pay your tax obligations on or prior to the target date, utilizing EFTPS.

- Submit your completely finished Form 941 in a timely manner.

- Record your tax obligation responsibility precisely.

- Send legitimate look for tax obligation settlements.

- Equip exact Kinds W-2 to your staff members.

- Submit Form W3 & Copies A of Form W2 with the SSA promptly & precisely.

941 Form 2020 Printable

Loading...

Loading...